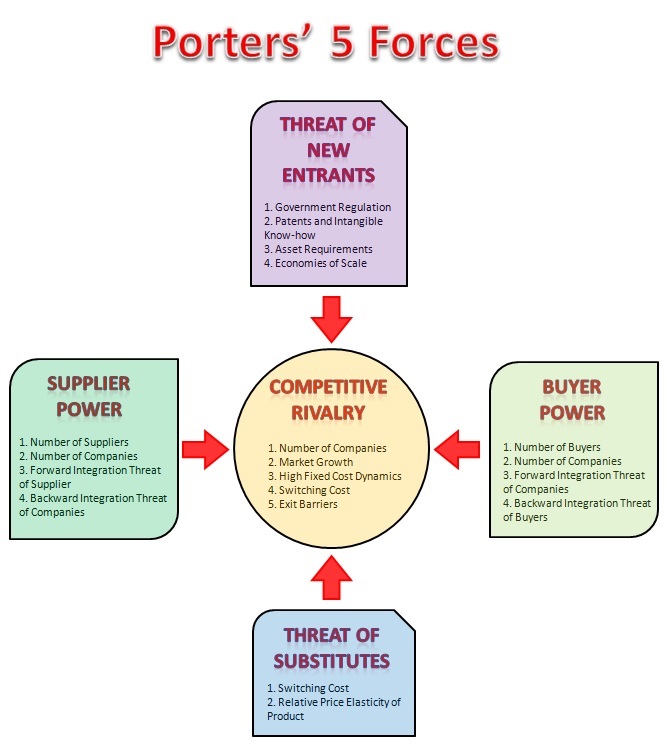

2.2 Porter 5 Forces Analysis to Determine Intensity of Competition in Industry

Why is it important to know the business industry the company is in? The answer is quite simple. No matter how good a company business model may be, it is difficult at times to excel due to the business industry and dynamics, whereby it is so highly competitive that the companies are struggling daily just to stay in business. In such cases, you might be better off focusing your efforts in looking at other companies to invest in and forfeit those companies within such a highly competitive business industry.

So let us get started to understanding what are the factors that can help you determine the business industry and dynamics the company is in.

Now that you understand more on business industry and how to analysis it using the Porters' 5 Forces, you are now in a better position to determine if companies in a particular industry is worth looking at.

Before we end this lecture off, here are some types of industries that you might want to avoid investing in.

1. Industry that requires heavy capital expenditure to operate. This should be obvious after the sharing on the airline industry. A lot of maintenance capital expenditure needed like to maintain existing planes or even to buy new planes to stay competitive. Such industries that require heavy capital expenditure often leaves little cash and hence shareholder returns are lower.

2. Industry that is subjected to price pressures. For example, sugar is a commodity-type of industry. You normally do not care about the brand much other than to make sure it is safe. But if you see sugar being sold in supermarket, you are at least sure the necessary authorities have done their due diligence to ensure it is safe. So, you buy whichever is cheaper by price. When one company cuts price, the competitor would also lower their price resulting in a price war and ultimately creating lower profit margins for the companies in the industry.

3. Industry that is subjected to constant change. This is the one reason why one of the greatest investor, Warren Buffett, avoids technology stocks. Technology companies need constant research and innovation to stay competitive. Such research often requires lots of capital and worse still is that you will never know if the research would ultimately be useful and hence be profitable in the end. In a sense, the major problem with such industries is that an investor cannot predict what the economic landscape would be in the long run nor foresee the changes that are going to happen.

4. Industry in the sunset years. While mails and letters deliveries were important in the past to help people communicate with each other, they no longer possess the same kind of importance that they once were. They are now subject to substitutes like emails, text messages on phone and in fact social networks like Facebook.

There are likely other industries that would make this list but we believe you would be able to determine it using the Porters' 5 Forces.